Let’s talk about a topic that might be giving you sleepless nights: bookkeeping. It’s like that friend who’s always there, sometimes supportive, sometimes a bit overwhelming. The big question is: to outsource or not to outsource your bookkeeping? It’s not just about crunching numbers; it’s about understanding your business’s heartbeat.

Let’s dive in, first with a story of one of my very first clients, let’s call her Sally…

Sally was not doing her bookkeeping herself, nor did she have a bookkeeper. When filing her taxes, we spent our time sifting through 12 months of financial data to prepare something that resembled a tax return. It was a disempowering experience for both myself and Sally (accountants simply can’t do their best work during tax season when they spend all their time organizing, rather than analyzing!)

One day she called me elated with news: she incorporated her business. My stress levels immediately began to rise, all I could picture was the future mess if she didn’t hire a bookkeeper ASAP. (note: for incorporated businesses, there is a lot more compliance, a bookkeeping system maintained properly and regularly is non-negotiable!)

After my initial shock wore off, I kindly explained that she needed to hire a bookkeeper, or learn to do her books properly (with my guidance). I would not file her taxes next season without a set of up to date, reconciled books in QuickBooks. After some thought she decided to outsource her bookkeeping, stating that she didn’t want to be involved with the finances.

I referred her to a bookkeeper and months later I checked in with Sally. She candidly shared with me that she was frustrated by how much work she still had to do: answering questions, uploading receipts, reviewing numbers.

Note: A misconception about outsourcing your bookkeeping is that you are completely hands off. Unfortunately, you’re still responsible for overseeing your bookkeeping and providing the information needed to the bookkeeper.

I explained that as a solopreneur, she was the holder of all of the financial information (both on paper, and in her head) therefore she was the best bookkeeper for her business and would not see significant time savings from outsourcing.

She then joined Chillbooks, we worked on setting up her bookkeeping system in QuickBooks and outlining her monthly tasks. She continued to manage her books herself for the following 12 months, the business entered a period of significant growth and then she began outsourcing again.

Sally is now a 7 figure business owner and is still grateful to this day that she managed her own bookkeeping, it’s given her the knowledge necessary to efficiently and confidently work with a bookkeeping firm.

Outsourcing is not a one size fits all approach. Most accounting firms will tell you to outsource your bookkeeping, no questions asked. And many self-employed people feel that this is an area of their business that they should leave to the professionals.

Inside this blog post I will walk you through considerations in making the decision to outsource or manage your books yourself. We’ll even chat about the disadvantages of outsourcing which is not something that is discussed often within my Canadian CPA circles.

Should you outsource your bookkeeping?

Most accountants won’t encourage you to manage your own bookkeeping because they are not prepared to provide you with the comprehensive training required to self-manage. Further, they don’t trust non-accountants to do the job and fear they’ll have to waste time fixing and cleaning up mistakes at the end of the year.

As a CPA who has trained hundreds of self-employed people to do their own bookkeeping in house using QuickBooks, I can confidently tell you that outsourced bookkeeping is not always the way to go. I work with Canadian CPA’s who happily take on Chillbooks graduates because they know the appropriate training has been provided.

So, how do you know when it’s time to outsource? Consider the following:

- Business Size: If your business is growing exponentially, then it might be time to call in the pros. Outsourcing can handle your growth spurt without you losing your mind.

- Complexity: Assess the complexity of your bookkeeping. Here are a few things you want to reflect on: # of bank accounts and credit card accounts your business has, the # of pages of each bank account or credit card account (are there alot of transactions?) whether you are working in multiple currencies, are you selling globally?, do you sell your product/service on multiple platforms? Do you have 12+ months of backlog to catch up on? Do you have employees that are on payroll? The more complex your bookkeeping is, the more likely you will save time and money by outsourcing. More complexity = more potential for mistakes, and mistakes are costly when you’re dealing with the tax man 😉

- Budget: Do you have the financial muscle to afford a monthly bookkeeper? As of the time of writing this article, the average starting rate for basic bookkeeping for a sole proprietor is around $300-$400/month. If you’re not prepared to cough up the monthly fees then it’s time to roll up your sleeves and learn to do it right, yourself.

- Team Members: Do you have someone on your team that can tackle the bookkeeping with you? With the right training, you can leverage your current in house resources to manage the books in house. Alternatively, if you have a large team and are struggling to manage contractor/payroll payments, that’s often a sign that it’s time to outsource.

- Business Type: If you are a service based solopreneur then you are likely doing most of the bookkeeping already via invoicing your clients and organizing your receipts, so you won’t save much time by outsourcing. If you sell products, your books are more complex because you are purchasing the goods for resale, and that increases the volume of transactions. Product based businesses also are likely to use an ecommerce platform which will need to be integrated with your bookkeeping system. You need professional help with that!

- Consider whether you are delegating, or dismissing your finances: Ok. Real talk, you can never fully outsource your business finances. So, before you decide to outsource, assess whether you have a blind spot to address. Take the time to learn about bookkeeping and financial statements before you make your decision. Outsourcing before understanding the basics is like outsourcing your social media without knowing what Instagram is.

I recommend taking 15 minutes to write out reflections on the above points. If the answer doesn’t come to you immediately, sit on it for a few days, maybe speak with other self-employed friends and that will help you get clarity.

How much does it cost to outsource a bookkeeper?

Ah, the million-dollar question (not literally, thankfully). The cost of outsourcing a bookkeeper can vary: you might find bookkeepers who charge hourly, some with monthly packages, and others who might accept a trade in homemade cookies (just kidding on the last one).

Based on my experience I have seen bookkeeper rates of $20-$90 per hour. This is a wide range, and it’s because bookkeeping is not regulated. There are many bookkeepers who do not know what they are doing, and the service standard is not the same across the board. I recommend outsourcing to a Chartered Professional Accountant (CPA) Firm or to a Certified Professional Bookkeeper. I’ve heard WAY TOO MANY horror stories about mismanaged bookkeeping and disappearing bookkeepers.

Most firms within my network start their rates between $300-$400 per month for basic bookkeeping, this increases based on complexity. If you have a backlog, be prepared to pay for these monthly fees retroactively.

Remember when shopping for a bookkeeper, it’s not just about the cost; it’s about the value and piece of mind they bring to your business.

When’s the Best Time to Outsource Your Bookkeeping?

Timing is everything, right?

This section is for you if your business is already established. If you are just starting out, your first step is to get educated on how your business finances work. That way you understand what you’re thinking about outsourcing (see my comment above about delegating vs. dismissing)

Ok, now let’s assume you understand bookkeeping, and with the appropriate training you’ve been managing it in house. The best time to outsource is when your business starts feeling like a wild horse – hard to control and always running.

This could be during a growth phase, for example:

You’re expanding your business offerings and will be integrating new systems and processes with the growth.

Or

You’re hiring your first team member on payroll. Payroll is complex, and something that needs to be managed actively each month. If you’re someone who is always behind on your books, setting up payroll is your time.

The Pros and Cons of DIY vs. Outsourced Bookkeeping

DISCLAIMER: The following pros and cons are reflected of DIY Bookkeeping done with appropriate training.

DIY /Self-Managed Bookkeeping

| Pros | Cons |

| Cost-Effective: Saves on monthly outsourcing fees or annual fees when filing taxes. | Time-Consuming: If your books are complex, bookkeeping will take time away from core business activities. |

| Direct Control: Piece of mind that you have full control over your financial data and bookkeeping processes. | Potential for Errors: Potential for mistakes in financial records that can be challenging to fix if you do not have someone supporting you. |

| Personal Involvement: Ensures every potential tax deduction or credit is considered, as the owner is personally overseeing the numbers. | Scalability Issues: As the business grows, DIY bookkeeping will become unmanageable. |

| Educational Value: Provides you with a deeper understanding of your financial situation. |

Outsourced Bookkeeping

| Pros | Cons |

| Professional Expertise: Confidence that you have a skilled professional working efficiently. | Cost: Can be a significant expense, especially for small businesses with limited budgets. |

| Time-Saving: If your books are complex, bookkeeping will free up time for you to focus on business operations. | Less Personal Involvement: May not capture every possible tax-saving opportunity due to less personal investment in the business’s financial minutiae (I see this A LOT with self employed people who enroll in Chillbooks after they have outsourced their bookkeeping) |

| Advanced Reporting: Ability to request more detailed financial reports and have a professional look at your numbers with you. | Costly Assumptions Made by Bookkeepers: Sometimes bookkeepers make assumptions for efficiency that could lead to higher tax bills, especially in areas like GST/HST Input Tax Credits or distinguishing personal vs. business expenses. |

| Scalability: Can easily handle increased complexity as the business grows. | Reduced Control: Business owners have less direct oversight of day-to-day bookkeeping tasks. |

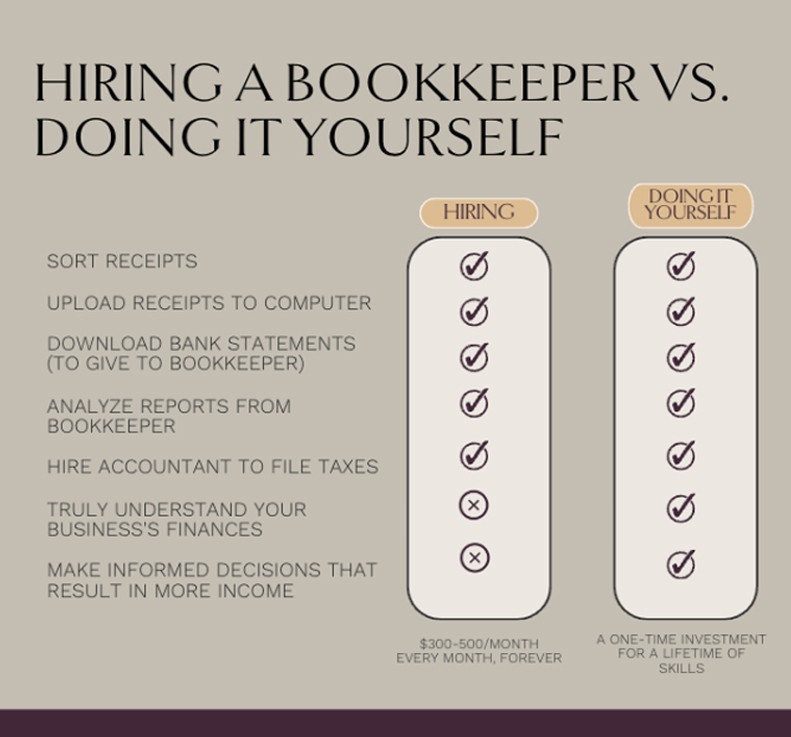

Task Comparison Chart:

Maximizing ROI: Getting the Most Out of Bookkeeping Outsourcing

Ok by now you will have decided if outsourcing is for you! I’ve heard a ton of horrible experience about poor service or simply bookkeepers who do not know what they’re doing.

Let’s talk about how to get the most out of working with an outsourced bookkeeper.

- Communicate clearly: Set clear goals of what tasks need to be done by when, and ensure that you are providing their team with the information they require to do their job. This often looks like: Bank Statements, Credit Card Statements, Receipts for Expenses

- Treat it like a strategic partnership: This is not just about offloading work; it’s about building a relationship that helps your business thrive. Let them know what you’ve found helpful, and where you are feeling challenged. Ask questions about your monthly reports.

- Scope of Work: Ensure that they provide you with an outline of the tasks they will complete on a regular basis. And follow up on these items if they are not providing you with updates, it is still your job to oversee the finances as the CEO.

- Accounts Receivable Management

- Accounts Payable and Receipt Management

- Bank and Credit Card Reconciliation

- Financial Reporting (provide Profit and Loss and Balance Sheet Reports)

- Other items to ask about:

- Software Subscriptions – will they be including the cost of software subscriptions (ex. QuickBooks, Dext, Hubdoc) as a part of their fee or will you be paying this separately

- Q&A Support – will they be available to answer questions through the month. Will they walk you through your financial reporting? Get clear on the level of support they will provide and what your needs are

- Hire a professional: In Canada, hiring a CPA firm or a CPB will reduce the chances of you ending up with a bookkeeper who does not know what they are doing

Having the right conversations during the hiring process and early on in the relationship will set the tone for your working relationship, get it right from the start!

Making the Smart Choice with Strategic Bookkeeping

Outsourcing or self-managing your bookkeeping is a strategic decision that you should not take lightly because your business finances determine your livelihood. The sooner you make a decision, the sooner you’ll stop dreading tax season and start embracing the benefits of bookkeeping.

If you want to manage your bookkeeping in house, or understand the basics of bookkeeping before outsourcing: check out Chillbooks™.

Inside the Solopreneur Write Off Guide you’ll get a checklist of 40 Solopreneur Write Offs that you can claim this year (and forevermore) so that you can feel confident that you’re not overpaying in tax.

Inside the Solopreneur Write Off Guide you’ll get a checklist of 40 Solopreneur Write Offs that you can claim this year (and forevermore) so that you can feel confident that you’re not overpaying in tax.