Picture this, you’re stoked because you just sent off your financial statements to the accountant. QuickBooks™ made it super easy for you this year, and you’re feeling like an actual financial whiz in your business. Yay, go you!

Until you open your inbox the next day to a ton of questions like:

“What does this transaction relate to?”

“Is this a personal or business investment?”

“Are there some transactions missing?”

And let’s be honest, you do NOT know the answers. Like you know what you spent, but you aint sure why the math isn’t mathing inside QuickBooks™.

You thought QuickBooks™ would make doing your bookkeeping sooooo much easier, and now you’re spending the day stressed out trying to figure out transactions from months ago.

Now don’t get me wrong, I love QuickBooks™, I use it as a solopreneur, it’s literally the GO TO for small business owners in Canada. But… and, this a big BUT… you NEED training on how to use it and set it up intentionally based on your needs. Otherwise, you’re going to end up with constant headaches like this even if you outsource (which you don’t need to do by the way). And no one wants that!

To help, I’m going to share the top 4 mistakes I see solopreneurs make with QuickBooks™, AND exactly how to fix them!

But before we dive in, here’s the thing, you may have signed up for QuickBooks™ thinking you can do this all yourself, but I promise you, if you truly want to crush your books not just at tax season, but year round, investing in the right training will literally change your approach to bookkeeping… and the number of zeros on your bank account at the end of the year.

QuickBooks™ Mistake 1: Incorrect Reconciliation

Hands up if you’ve ever googled how to reconcile in QuickBooks™ or how to undo reconciliation. **Awkward hand raise**. You are not alone. This is probably the most common mistake I see solopreneurs making when it comes to QuickBooks™.

When I ask people “have you reconciled your bank accounts?” – I usually get a “yeah, I’ve categorized and reviewed everything”. THIS IS NOT RECONCILING!

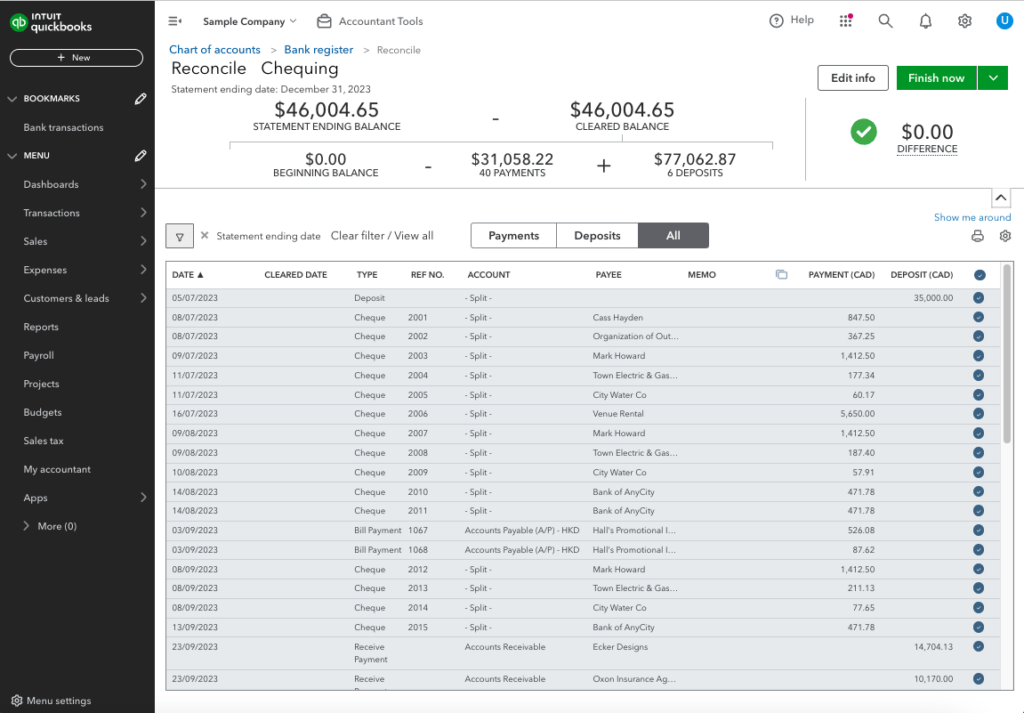

Proper reconciliation means matching your QuickBooks™ records with your bank statements to make sure it all tallies up.

Why is it such a big deal?

Reconciliation is how you catch errors – like duplicate transactions, missed entries, or incorrect amounts.

Literally, all of your financial reports rely on this process. If it doesn’t match your numbers will be unreliable and you risk making some bad business decisions and potentially some tax issues too. And no one wants that!

So, how do you fix this?

First, make sure you’re using the QuickBooks™ reconciliation feature, not just reviewing transactions. You need to match EVERY entry back to your bank statement. Cent to cent.

Now before you run for the hills, A LOT of this is automated through their reconciliation function, so all you really need to do is look at any mismatched amounts.

Having said that, you DO need to reconcile from day one. Each month depends on the last, so if any previous reconciliations have errors, then it’ll haunt you for years until you fix it.

Thankfully, your girl here has your back.

In Chillbooks™ I provide you with a bank reconciliation cheat sheet where there is a flowchart telling you exactly what to do based on the issue you’re running into in the bank reconciliation screen.

This makes the entire process super simple and headache free – promise.

QuickBooks™ Mistake 2: Connecting Too Many Bank Accounts

Be honest… how many bank accounts have you got connected to your QuickBooks™ account? 4, 5, 6, maybe more?

Here’s the deal: you need a dedicated business bank account, business credit card, and business savings account.

Now, I’m not going to tell you off for having the odd personal transaction go through your business account, life happens, we’ve all done it, even me. But the accounts you connect to QuickBooks™ should be primarily for business use.

If you’re mixing personal and business transactions it’s gonna make your financial picture look a bit of a hot mess. And you’ll create even more work for yourself trying to identify what is and isn’t a business expense.

So, how do you fix this?

- Set up a business bank account, business credit card, and business savings account. Try and keep your personal and business transactions separate as much as possible.

- Only link your designated business accounts to QuickBooks™. This is going to help make sure your financial data is clean and organized.

- Regularly review your connected accounts to make sure they are used primarily for business. If personal transactions slip through (it happens), categorize them correctly to keep your records accurate.

Trust me, you’ll get a lot less questions from the accountant (and wayyy less headaches).

QuickBooks™ Mistake 3: Not Recording Personal Payments and Investments Properly

Another really common mistake I see is not people not paying themselves, or not doing it right.

This includes using personal funds to pay for business expenses, using business funds to pay for personal things, or taking money out of the business for personal use.

This is something I talk about a lot in Chillbooks™ because if you’re not recording these transactions properly it’s gonna lead to a lot of confusion and inaccurate financial records. You need a clear system for tracking these movements.

And please please please whatever you do – do not “exclude” personal transactions from your bank feed. This is going to throw off your reconciliations literally forever (see Mistake 4 below)

The best tip I can give you for this is to set up a “Shareholder Loan” account in QuickBooks™, even if you’re not incorporated (you want to future-proof your bookkeeping). It might sound a bit scary, but basically, this is where you record any personal money put into the business or any business expenses paid with personal funds.

QuickBooks™ Mistake 4: Excluding Transactions

Okay, now this one is a biggie! And it’s usually completely innocent.

It usually goes like this: “oh, this is personal, I’ll just exclude it.” You should NEVER, ever, ever exclude any transaction from any of the accounts connected to your QuickBooks™ unless there’s been a genuine glitch, like an incorrect transaction sent by the bank.

As soon as you exclude something, your bank balance will no longer match your QuickBooks balance™, making it IMPOSSIBLE to reconcile your accounts accurately (and we’ve already talked about how important that is).

So, if you did accidentally pay for your Tim Hortons on your business card, it’s fine. Just categorize it as a personal expense via your Shareholder Loan account, rather than excluding it completely.

Ready to Become BFFs with QuickBooks™ Online?

Feeling a bit more confident about tackling those QuickBooks™ mistakes? I really hope so!

But don’t stop there.

Understanding your finances and getting to grips with bookkeeping is essential for any successful business owner. You need to know where your money is coming from and where it’s going, so you can make those bold business moves that are gonna allow you to scale.

That’s exactly what Chillbooks™ is here for.

I created this small business bookkeeping course to empower you to embrace your financial potential. You’ll not only learn how to master QuickBooks™, but you’ll also gain the confidence and clarity needed to grow your business with a whole lot more chill.

You don’t need to be an accounting pro to understand the basics. And you don’t need to spend hours agonizing over it every month to get it right.

When you know how to leverage QuickBooks™ in your business, you can keep more money in your pocket and say goodbye to financial anxiety and stress.

Inside the Solopreneur Write Off Guide you’ll get a checklist of 40 Solopreneur Write Offs that you can claim this year (and forevermore) so that you can feel confident that you’re not overpaying in tax.

Inside the Solopreneur Write Off Guide you’ll get a checklist of 40 Solopreneur Write Offs that you can claim this year (and forevermore) so that you can feel confident that you’re not overpaying in tax.