Let’s be real, we ALL want to pay less tax, right?

But when it feels like it’s only the one percent who can get away with paying less tax, you might think as a sole proprietor that none of this is possible without being shady.

But that’s not true.

In fact, a lot of the tax efficiencies available to the big businesses are also available to business owners like you.

Whether you’re a mom & pop shop, online business owner, sell products OR services, when you know the right tax right offs available to you as a sole proprietor, you can significantly reduce your tax liability.

What sucks though, is that most businesses don’t know about all the tax write offs available to them to help lower their tax bill without being shady.

Which is why in this post I’m gonna break it down for you and make it SIMPLE to understand.

And if you’re a small business owner ready to crush your bookkeeping so you can make more money and feel more confident come tax season, don’t forget to check out Chillbooks™.

I believe that ALL business owners should be financially empowered to understand and do their own bookkeeping.

Honest, it’s not that scary once you break through all the financial jargon.

Do Business Owners Pay Less Taxes than Employees?

This is such a great question and one that I get a lot. But it is nuanced to say the least.

If you’re a business owner (which I’m guessing you are, most people who find my blog are solopreneurs); your business will likely be structured in either of these two ways:

- You’ll be a shareholder of a corporation – this sounds big and fancy but you can be a solopreneur and incorporate if it’s more tax efficient.

- You’ll have a sole proprietorship

Sole proprietors pay income tax on ALL their income for the calendar year. It’s filed on your personal tax return – the same one you’d file if you were a salaried employee.

Whereas, an incorporated business must pay corporate tax on all the income for the year, but they can control how much personal tax they pay based on how much they decide to pay themselves from the corporation (via salary or dividends).

Because when you’re incorporated, you can pay yourself with shareholder dividends or as an employee of your corporation with salary.

Now, whilst you may get to write off some expenses you incur in fulfilling your role as a salaried employee when filling out your annual tax return, this is the exception and definitely NOT the rule.

And the things you can write off as a salaried employee, don’t come close to the things you can write off against your business income as a business owner.

Therefore, you may find that if you run your own business, you will pay less taxes than what you would if you were an employee of a company; but as I said, this is nuanced and there are SO many moving parts to this.

It’s always worth checking with your accountant to see which is the most tax efficient way to structure your company (sole proprietor or incorporate) but essentially, when you’re an employee of any company, you pay personal taxes based on how much you were paid in the year.

And you still pay the same personal tax rates whether you’re a sole proprietor or salaried employee. It’s just that business owners tend to have more write offs available to them when reporting their business income, which allows them to get creative with tax planning and write offs.

Know EXACTLY What You Can Write Off

Which brings me to my next point…and it’s super important.

One of the easiest ways for business owners like yourself to save money on taxes is by knowing exactly what you can write off as an allowable deduction.

It’s always nice to see that tax bill reduced, right?

So if you’re a sole proprietor or have a corporation and are looking to make sure that you never miss ANY tax write offs and feel confident that you’re never overpaying in tax (because that would suck), then check out my completely free solopreneur write off guide

And be mindful of the lesser known tax write offs; because I see so many business owners miss out on these and it could literally save you hundreds (if not thousands) on your tax bill.

And if you’re like: “Jami, I don’t know what I don’t know” – I’ve got you! I covered them inside my ultimate guide to tax write offs post I shared a couple of weeks back.

Can an Accountant Save you Money on Taxes?

Lots of people hire accountants as a way to save money on taxes.

But me, I’m the CPA that doesn’t want to do your taxes…weird, huh?!

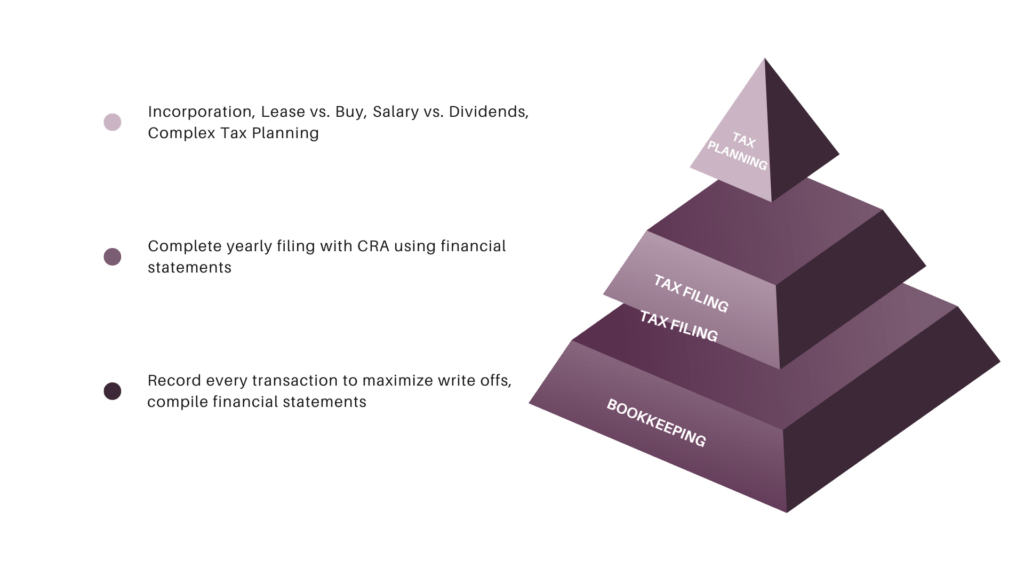

But there’s a reason for this…and so I can explain and give you a clearer understanding of why, I need to share with you my Maslow’s Hierarchy of Needs (Tax Edition) to explain the difference between accounting, tax planning, bookkeeping and so on and where you/your accountant would come into this.

At the base of the pyramid lies your Bookkeeping – this is the act of recording everything that’s happening in your bank account and credit card account for your business. So the bookkeeping section is where you’ll be minimising your tax bill, tracking expenses and write offs etc.

You don’t need to be good at math, by the way, to do your own bookkeeping, there are tools and software that do the adding and subtracting, your bookkeeping is the system, the tracking of the sales and expenses.

In the second tier, you see tax filing and this is where most people hire accountants and I get it. It’s handy to have an accountant at this point because they know EXACTLY how to fill out those government tax forms correctly.

And at the top of the pyramid, you have tax planning. This is where having an accountant pays dividends – all puns intended – because they can look at your numbers and tell you the most efficient way to expense things. For example, should you lease or buy a car, is it more tax efficient to put it through the company? And so on.

But the mistake most business owners make is they pay for an accountant, but essentially they’re paying them to do their bookkeeping for them, instead of taking control of the bookkeeping themselves and using the accountant to help them tax plan instead.

So can an accountant save you money?

OMG yes!

But only when you use them for the right jobs. And it’s my belief that you’ll forever be the best bookkeeper in your business because you know your business way more than your accountant.

So you can take control of this and then get help from your accountant to file and then tax plan and get a way better ROI from an accountant.

Make sense?

The truth is, whilst you could outsource your bookkeeping, having the skills and tools to track your write offs and understand the financial health of your business will be a game changer for you; then you can focus on the fun tax planning side of things with your accountant.

Most people who complete my Chillbooks™ course find that once they’ve nailed their monthly processes and understand what things mean, they feel comfortable filing their taxes themselves too which is an added bonus, meaning you’ll only really want to hire your accountant for those “top of pyramid” duties…way more efficient.

Stay On Top of your Bookkeeping

After seeing the above, I hope that you can now see that being tax efficient means you need to know your books. And no one should know your books like you do. It’s a non-negotiable for any business owner who wants to build a sustainable and profitable business.

Thankfully nowadays it’s super easy to stay on track with your bookkeeping and your taxes so you don’t get any nasty surprises during tax season.

I always use QuickBooks for my own bookkeeping and recommend it to all my clients.

It makes tracking and managing your expenses and your books super chill and is THE best accounting software I’ve come across in my professional career – I mean, I built an entire course around it so you know it’s pretty sweet.

And if the thought of learning how to navigate a new (or different) bookkeeping software is filling you with dread, you just need to chill(books), I’ve got you – my online course, Chillbooks™,is literally designed for you – the solopreneur who’s ready to get to grips with this whole doing your own taxes thing.

Inside the Solopreneur Write Off Guide you’ll get a checklist of 40 Solopreneur Write Offs that you can claim this year (and forevermore) so that you can feel confident that you’re not overpaying in tax.

Inside the Solopreneur Write Off Guide you’ll get a checklist of 40 Solopreneur Write Offs that you can claim this year (and forevermore) so that you can feel confident that you’re not overpaying in tax.