Picture this: It’s a peaceful Monday morning, and you’re finally catching a break with your favourite cup of coffee. Suddenly, a wave of panic hits – “Did I miss the GST/HST filing deadline?”

You frantically check your calendar and paperwork, trying to remember when it’s all due. Sound familiar? Don’t worry, you’re not alone.

As a small business owner, keeping track of tax deadlines can be overwhelming, but it doesn’t have to be. I’ve worked with many clients like you, and I know how stressful it can be to navigate the maze of tax obligations.

But here’s the good news: With a little bit of guidance and the right information, you can totally handle your GST/HST filings like an absolute pro.

In this post, I’ll break down everything you need to know about GST/HST filing deadlines, so you can sip that coffee in peace and never stress about them again.

What is GST/HST?

Alright, let’s start with the basics. HST stands for Harmonized Sales Tax.

Sounds fancy, right?

But really, it’s just a combination of the federal Goods and Services Tax (GST) and the regional Provincial Sales Tax (PST). This unified tax is applied to most goods and services in participating provinces across Canada.

Think of it as a sales tax tag team – two taxes joining forces to simplify the process. So instead of dealing with multiple tax rates, you’ve got one harmonized rate to keep track of.

If you’re new to this or need a refresher, I’ve written an entire guide on navigating GST/HST. It covers everything from when you need to charge GST/HST to how it works for clients in different provinces. It’s like having your very own tax-savvy bestie (aka me) by your side, guiding you through every step.

When is the GST/HST Filing Deadline?

If you want to stay compliant and avoid penalties (which I’m sure you do, since you’re reading this), you NEED to know your deadlines.

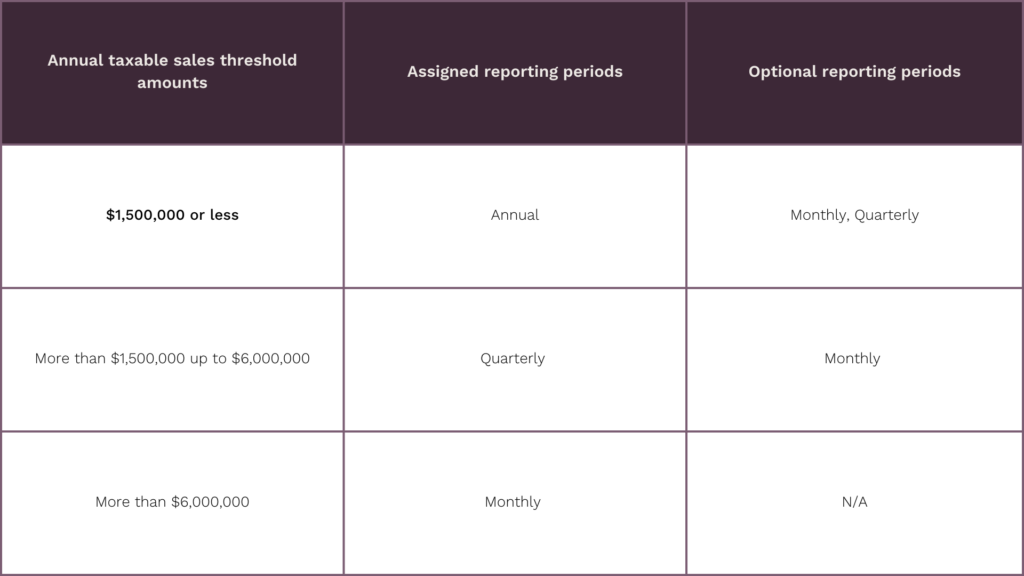

Your deadlines are going to depend on your reporting period, which can be quarterly, annually, or, in some cases, monthly.

Here’s a quick look at how reporting periods are generally assigned based on your annual taxable sales:

Should I File Quarterly or Annually? What are the Filing Deadlines?

For many small businesses, annual filing is the standard. However, fun fact – a LOT of business owners like to file quarterly because it forces them to stay on top of things – if you’re this kind of small business owner, let’s be friends!

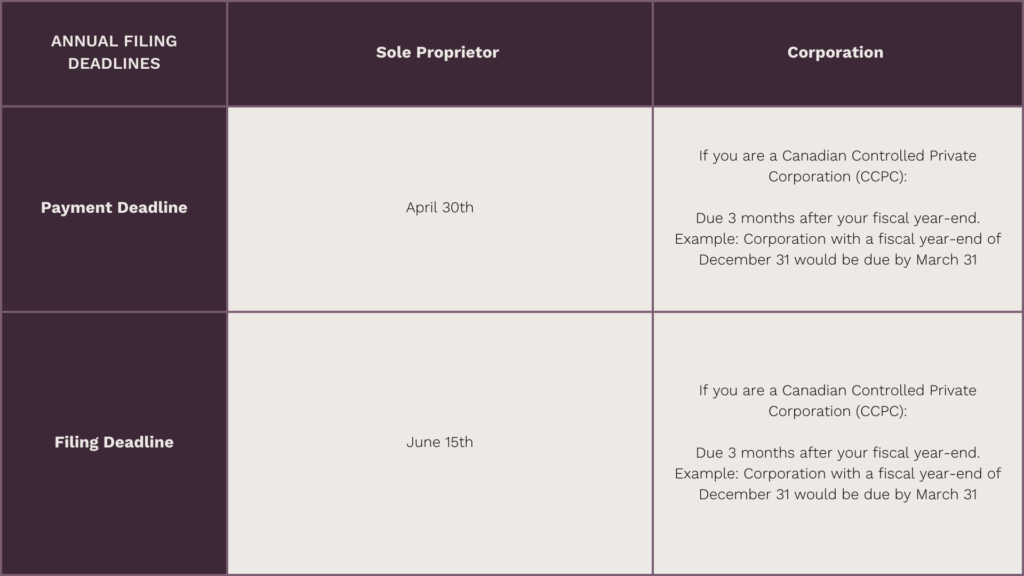

Payment deadlines and filing deadlines are two different deadlines and I talk about this more in my Ultimate Guide to GST/HST.

Your deadlines will also depend on whether you’re a sole proprietor OR a corporation.

I broke things down into a couple of quick reference guides so you can easily see when you need to pay and file your GST/HST.

As a business owner paying your GST/HST annually the following applies to you:

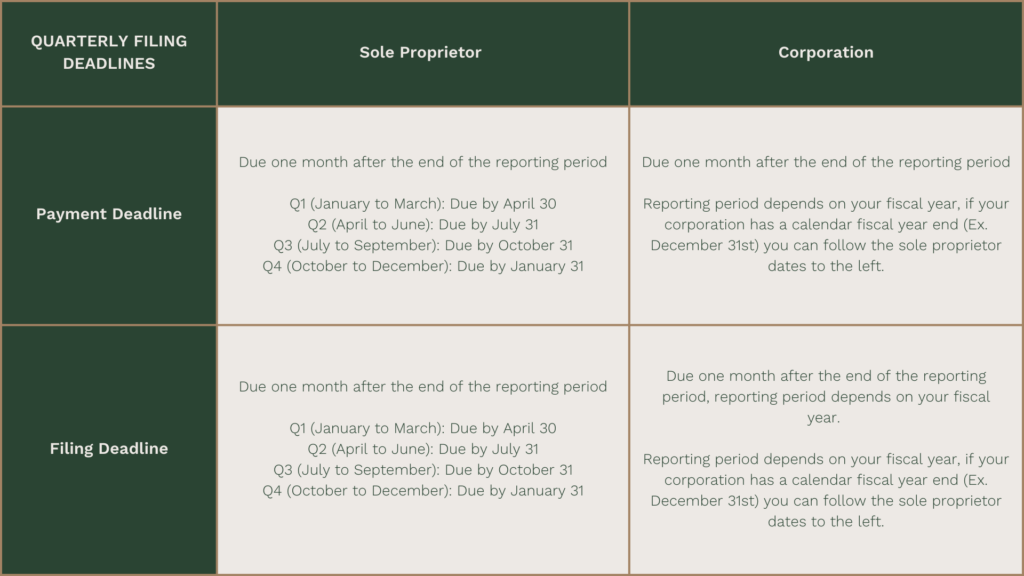

As a business owner paying your GST/HST quarterly the following applies to you:

YEP – your payment and filing are due at the sime time if you file quarterly as a sole trader OR a corporation

Here’s an example breakdown for a business whose reporting period aligns with the calendar quarters:

- Q1 (January to March): Due by April 30

- Q2 (April to June): Due by July 31

- Q3 (July to September): Due by October 31

- Q4 (October to December): Due by January 31

If your business files annually, you’ll only need to submit your GST/HST return once a year. This can be a great option for smaller businesses or those with simpler financials and not too much going on.

But like I said, if you wanna stay on top of things, quarterly filing can make things feel a little less intense at tax time.

Remember, even though you only file once a year, you still need to keep accurate records throughout the year if you want a headache-free year-end.

Instalment Due Dates

You may have to pay quarterly instalments for your GST/HST regardless of whether you file annually or quarterly.

Why? When you owe more than $3,000 in GST/HST in the previous year, the government doesn’t want to wait until the end of the year for you to file to receive their GST/HST cheque. So they ask you to pay it throughout the year.

Instalment due dates (if you owed more than $3,000 in GST/HST in the previous year) are April 30, July 31, October 31 and January 31.

This means that you can be FILING annually, AND PAYING quarterly instalments. This is not to be confused with FILING quarterly.

You can have up to three different GST/HST deadlines:

1. GST/HST Filing Deadline

2. GST/HST Payment Deadline

3. GST/HST Instalment Payment Deadlines

Do I Need to Submit Monthly GST/HST Returns?

Monthly filings are less common and usually apply to larger businesses with higher revenues, or those who prefer to manage their cash flow on a more frequent basis.

If you find yourself in this category, your GST/HST returns are due one month after the end of each reporting period. So, if your reporting period ends on January 31, your GST/HST return is due by the end of February.

For some businesses, monthly filing can help spread the tax burden throughout the year, making it easier to manage.

GST/HST Calculator

Let’s face it, crunching numbers isn’t everyone’s idea of fun (just mine). But don’t worry, I’ve got just the thing to help you out…

My FREE TRACKER inside, What the HST Am I Doing?, is designed to make filing your GST/HST an absolute breeeeeze!

Inside you’ll find a handy tool that not only calculates what you owe or what refund you’re entitled to, but it also keeps all your GST/HST-related info in one place. With this tracker, you can effortlessly manage your sales tax, stay on top of filing deadlines, and maximize your returns.

Sound good?

And if you need to double-check how much GST/HST to charge your clients, the CRA has a great GST/HST calculator that will do this for you.

Filing GST/HST Returns Isn’t as Scary as You Think

I get it – filing GST/HST returns can seem like a daunting task, especially when you’re juggling a million other things in your business.

But with a little organization and the right tools, it’s entirely manageable. Keep detailed records of all your sales and purchases, set regular reminders for your filing deadlines, and make use of resources (pssssst I have a few FREE ones here), to stay on track.

Remember, you’re not alone in this. Many business owners find GST/HST filing intimidating at first, but with practice, it becomes just another part of running your business smoothly.

So take a deep breath, grab your calculator (or my handy GST/HST tracker), and tackle your GST/HST returns with confidence. You’ve got this! And if you ever need a bit of extra help, you know where to find me.

Together, we’ll make tax time a stress-free experience.

Inside the Solopreneur Write Off Guide you’ll get a checklist of 40 Solopreneur Write Offs that you can claim this year (and forevermore) so that you can feel confident that you’re not overpaying in tax.

Inside the Solopreneur Write Off Guide you’ll get a checklist of 40 Solopreneur Write Offs that you can claim this year (and forevermore) so that you can feel confident that you’re not overpaying in tax.