Harmonized sales tax and filing GST/HST for small business operators is just a part of the day-to-day workings of being tax-compliant in Canada. I can hear those sighs already!

But, if you keep solid business records, dare I say you’ll find filing GST/HST for your small business easy.

If you’re reading this, I’m going to take a guess that you’ve got some questions. Maybe you’re wondering…”What is harmonized sales tax?”, “Does it apply outside of my province?”

Luckily, you’re in the right place! Because in this blog, I’m going to share EVERYTHING you need to know in plain, clear English so you can stop asking “What in the HST?!” and feel confident in your books.

What is Harmonized Sales Tax?

Harmonized Sales Tax is a cheeky hybrid of provincial sales tax (PST) and the Canadian goods and services tax (GST). It mixes the national tax we have to charge on consumed goods with any local ones and it’s charged at the point of sale. Bizarrely, it’s supposed to make filing your taxes easier, but I totally get it if you don’t feel that way right now.

To make it just a little more complex… it’s a variable rate.

Investopedia explains, “The HST rate is 15% in all participating provinces except Ontario, where it is 13%.” And it doesn’t apply to foreign buyers as long as they don’t use the goods in Canada. You’re only filing HST for small business goods and services that are consumed here in Canada.

What’s the Difference between GST and HST and PST?

GST is the basic 5% tax on goods and services in Canada set by our government.

PST is added separately in a few provinces including BC, Manitoba, Quebec and Saskatchewan. (But in Quebec they use QST to mean PST.)

However, HST is a blend of those two taxes meant to make collecting easier for businesses that operate in New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario and PEI.

So, if you’re filing HST for a small business, you’re done. But if you just pay GST and you’re in a PST province, you’ll need to look into registering for PST as well.

Do I Need a GST/HST Number for my Small Business?

If you are billing clients more than $30k over four consecutive quarters (a rolling 12 months) AND you live in Canada, then YEP! Sales tax applies to you.

*Congrats on making BANK!*

You’ll need to get a GST/HST number and charge GST/HST on your invoices. At the end of your reporting period, you’ll want to then make sure you’re filing GST/HST for small business with the CRA.

What HST Exemptions are There for Small Businesses?

If you run a very small Canadian business or sell goods/services that are exempt from sales tax, then harmonized sales tax won’t apply.

These are things like businesses that are specialised schools, offer exempt goods like groceries, exports and medical equipment OR if you make less than $30k before expenses. In those sorts of cases, you won’t have to register for GST/HST for your business.

(That was easy, right!?)

What Responsibilities Do I Have Once Registered for GST/HST?

While some of the language is scary (even for me), your responsibilities under GST/HST are really quite simple.

GST or HST registered businesses must:

- Charge the right amount of sales tax to the right clients

- Pop your GST/HST number on your invoices when you’re charging it

- Give some or all of what you collect in sales tax back to the CRA

How to Get Set Up with GST/HST and Calculate Your Bill as a Small Business

Calculating and filing sales tax can be a bit of a minefield to navigate, but if you’re struggling with how to calculate your GST/HST bill, I’ve got you.

Step One – Register

First, register for a GST/HST account with your Business Number (BN) from the Canada Revenue Agency (CRA). And in Quebec, you will want to register with Revenu Québec for GST and possibly QST.

Step Two – Charge

You need to pop your GST/HST number on all relevant invoices and charge the proper rate. (And to do that, you need to know where your clients/suppliers are located.)

If you don’t know where your customers are located, you’ll need to charge GST/HST based on your location.

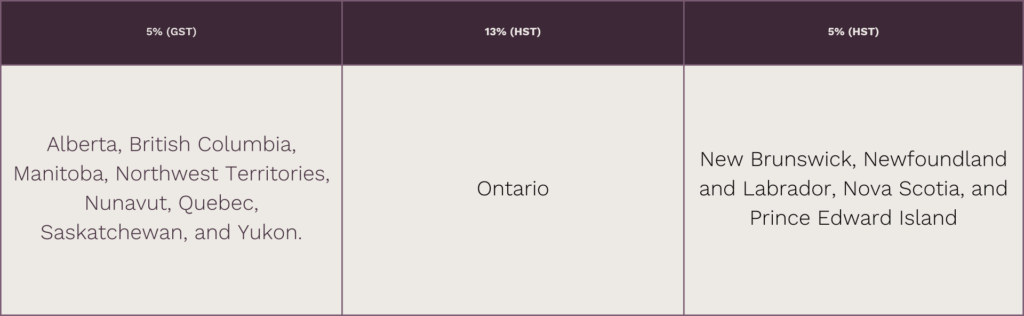

Inside my free GST/HST guide I help you with this but in short here’s what you’ll need to charge:

5% (GST) in Alberta, British Columbia, Manitoba, Northwest Territories, Nunavut, Quebec, Saskatchewan, and Yukon.

13% (HST) in Ontario.

15% (HST) in New Brunswick, Newfoundland and Labrador, Nova Scotia, and Prince Edward Island

So for example:

Let’s say you live in Ontario, and you are billing a client in BC. Based on the above you would charge them 5% because thats the GST/HST rate for BC. Simple right?

Now let’s take a similar scenario. You still live in Ontario, but you are billing a client and do not have their billing address. In this case, you’d need to charge them the Ontario rate of 13%.

Make sense?

Step Three – Calculate

For everywhere outside of Quebec, you’ll use one of these two ways to calculate how much GST/HST you owe:

GST/HST Regular Method

- Add up all the GST/HST you collected during the reporting period.

- Add up the total eligible GST or HST you paid on your own business expenses (you can claim credits – called ITCs – on those).

- Use the difference between these numbers to get your Net Tax Due (or Refund owed!).

Psssst.. I’ve created a FREE guide which includes a handy calculator that will help you with this step.

HST Quick Method (if allowed)

If your revenue is less than $400k across 4 consecutive quarters, you’ve been in business a full year before the reporting period, your supplies are eligible and you’re not an excluded business type; then the quick method is a great option.

- You charge your customers the full HST or GST, but then you’ll only pay a portion of the tax back.

- Just check your remittance rate here and add the figure to your return.

Step Four – File

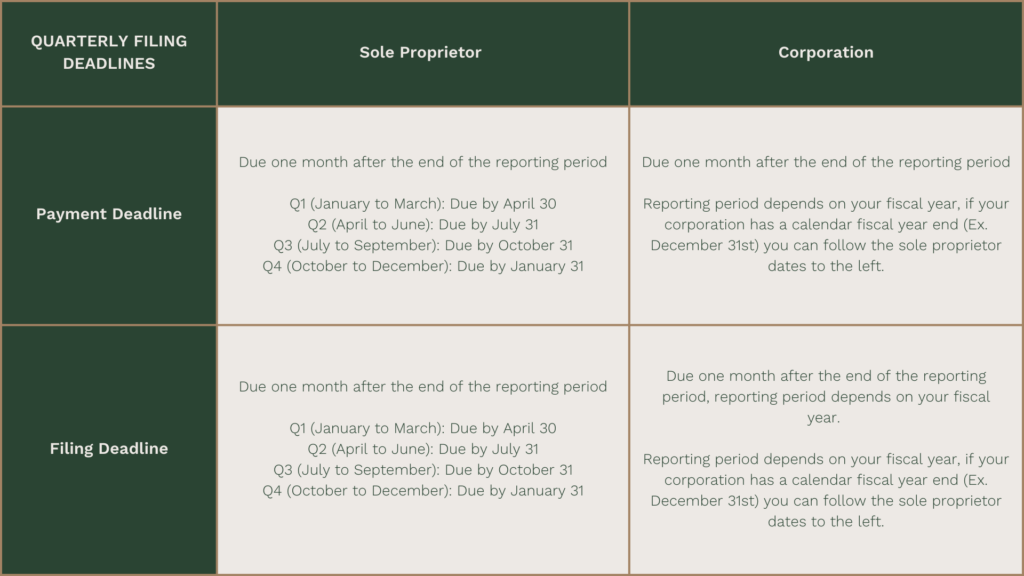

Then, you’ve got to file your GST/HST return by your reporting period (annually, quarterly or monthly). The CRA/RQ will tell you what your reporting period is.

Typically if you’re a solopreneur just starting out, you’ll be assigned an annual reporting period.

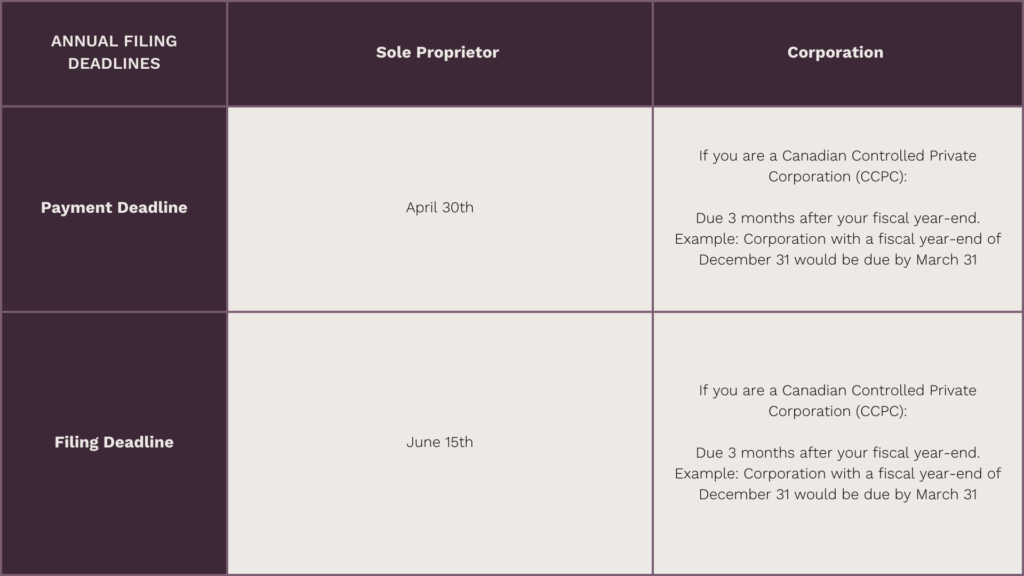

Here are the typical deadlines assigned by the CRA; please note that your payment deadline AND filing deadline can be different.

Annual filing deadlines are as follows:

So, for example, if you have a December 31st year end and you file your GST/HST annually, then you will have to both pay and file your GST/HST by March 30th of the following year.

If you file quarterly, payment and Filing are both due one month after the end of the reporting period as you can see in the below infographic:

NOTE: You have to file even if you don’t have any tax to remit and no transactions to show.

Payment Deadline vs Filing Deadline

Something to note if you’re a sole proprietor is that the payment deadline is BEFORE the filing deadline. Most people pay AND file at the same time (on April 30th, the earlier of the two dates) to make things simpler, however filing at a later date could make things easier for you if you need a bit more time to organize yourself and get your ducks in a row.

In this scenario, you’ll need to pay an estimated amount. I always recommend that you overestimate in this situation so you can just claim a refund for any overpayment when you file on June 15th.

If you don’t pay enough you will have to pay instalment interest on the amount that you should have paid which sucks.

Additionally, if you pay instalments through the year then really you’ve already prepaid your tax, so you can just file on June 15th and ignore the April 30th date which is nice.

What GST/HST should I be charging my US clients?

If you are selling to a client who is outside of Canada, and they use your goods/services totally outside of Canada, they don’t need to pay harmonized sales tax.

Isn’t that great?

That means it’s really important to know where your clients are AND where the stuff they buy from you is going.

PRO AUDIT TIP: If your client is outside of Canada and you do not charge them sales tax, you MUST keep your client’s legal name and address in your bookkeeping records as proof as to why you didn’t charge tax.

What Taxes Do I Charge When Selling to Other Provinces?

The CFoIB explains, “If a product was bought in your business, the customer pays your jurisdiction’s sales taxes. If a customer asks you to deliver products to a different province or territory, you charge the taxes of the jurisdiction where the product ends up.”

It’s fairly simple! It’s just about keeping really good records.

For reference, here are the sales taxes in the different Canadian provinces.

5% (GST) in Alberta, British Columbia, Manitoba, Northwest Territories, Nunavut, Quebec, Saskatchewan, and Yukon.

13% (HST) in Ontario.

15% (HST) in New Brunswick, Newfoundland and Labrador, Nova Scotia, and Prince Edward Island

Note that PST/QST are in addition as applicable.

*PSST…. I can help you out with all this* Grab my free GST/HST Tracker here!

Make Sure You Don’t Make this GST/HST Mistake!

You might think registering a business is the same thing as signing up for a GST/HST number. But it’s not. One has to do with taxes and the other is business setup paperwork.

The COJG explains, “The BN and BIN are different and distinct numbers for businesses.

A Business Number (BN) is assigned by the Canada Revenue Agency (CRA) and is

an identifier for tax purposes. […] A Business Identification Number (BIN) is the 9-digit number on the Master Business Licence that is used by the Ministry of Government Services to identify provincial business registration.” So, getting your Master Business License is separate from your sales tax (GST/HST) responsibilities.

When you register for GST/HST then you’re automatically assigned a BN (unless you signed up for one already with the CRA, but most people don’t do this!)

And if you don’t meet the threshold for charging GST/HST anyway… then you don’t need to bother with a BN at all. Win!

Filing and Paying Your HST/GST Online

Filing and paying your HST/GST online is the easiest way to do it. And, as of Dec 31st, 2023, the only penalty-free way for most businesses to file.

(They don’t want to faff about with paper forms anymore, obvs!)

All the different ways you can file online are listed here, but in short, you can file and pay everything through your CRA My Business Account

Don’t panic…just Chill(books)

If you’ve gotten this far (thanks for sticking with me) and all the sales tax terms are starting to blend together, I get it. But, I still strongly believe YOU ARE THE BEST BOOKKEEPER for your business. And with a little help, you can totally do this!

In my Chillbooks™ training course I’ll show you exactly how to understand and track everything properly so HST/GST (or any of the other TAX stuff) isn’t a nightmare anymore.

Want the lowdown?

You’ve got this!

Inside the Solopreneur Write Off Guide you’ll get a checklist of 40 Solopreneur Write Offs that you can claim this year (and forevermore) so that you can feel confident that you’re not overpaying in tax.

Inside the Solopreneur Write Off Guide you’ll get a checklist of 40 Solopreneur Write Offs that you can claim this year (and forevermore) so that you can feel confident that you’re not overpaying in tax.