Congrats on grabbing your “What the HST Am I doing?” Guide for the Canadian entrepreneur selling in a global economy.

👉 The guide is on it’s way to your inbox!

For a limited time get 62% off Never Miss a Write Off:

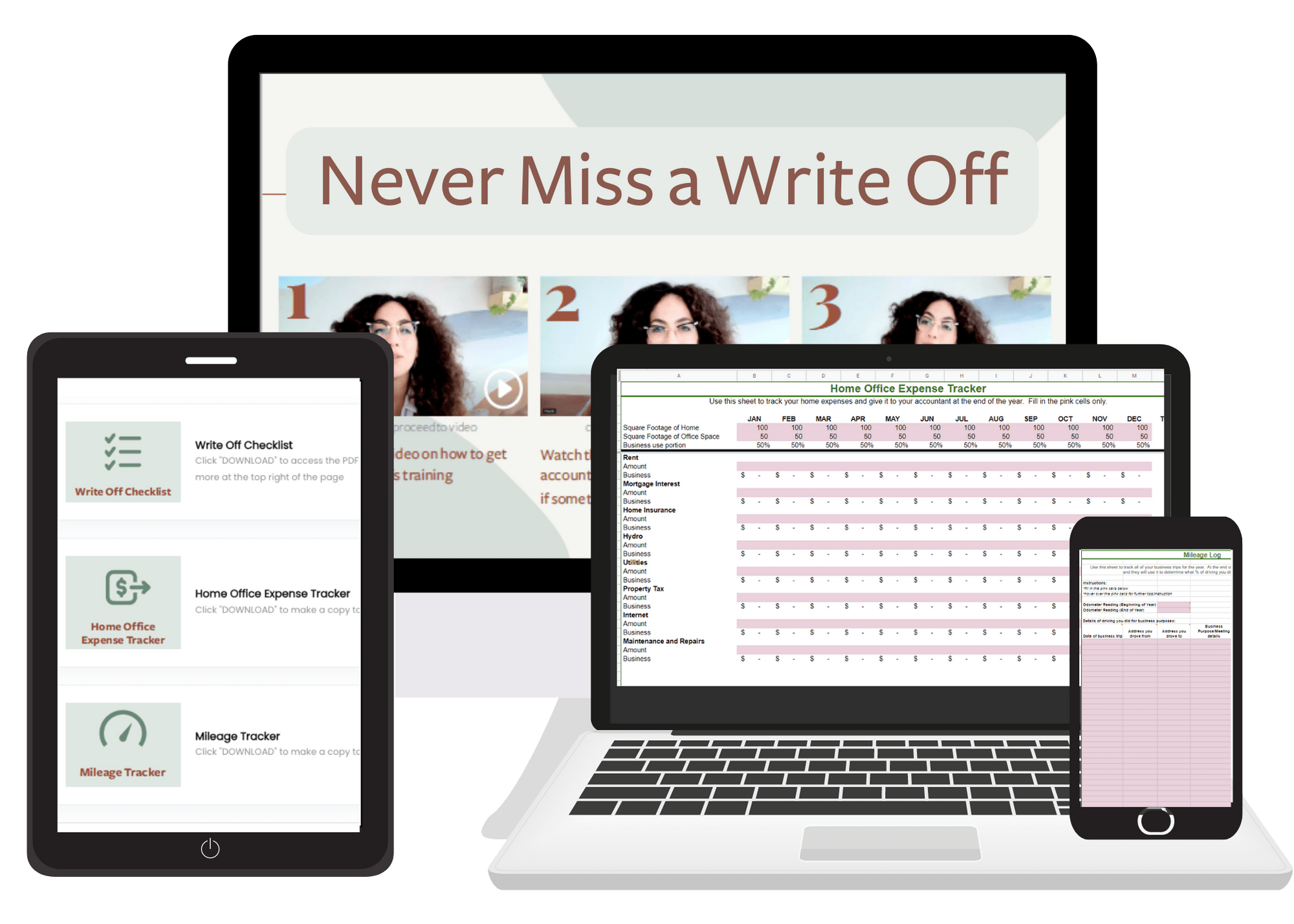

Plug and Play Home Office and Mileage Trackers designed to help you get your tax bill as low as possible using all the juicy write-offs available to you as a solopreneur…

I know that when tax season rolls around you sometimes get stressed that you’re missing write offs and paying extra tax for no reason.

That’s why I created “Never Miss a Write Off”

Inside this mini course you get all the hacks I’d share with my tax clients during our hourly Q&A sessions – from how to get out of tracking your mileage all year long, to what part of your mortgage payments you can write off.

I used to charge $400 for these Q&A sessions with my clients and this mini course is yours to keep for just $37.

This mini course will truly help you to CHILL OUT when tax season rolls around & have more cash in hand.

Get your hands on it now!

This offer will Expire in…

Normally Sold for $97

FINALLY enter tax season knowing that you’re paying what you’re supposed to be paying *and not a penny more*

Normally Sold for $97

GET ACCESS TO “NEVER MISS A WRITE OFF”.

Normally Sold for $97